- Cambridgeshire County Council proposes 4.99% council tax precept rise adding £84 yearly for Band D households

- Proposal funds adult social care (42% allocation), children’s services (28%), highways maintenance (£180m backlog)

- Budget gap £92m due to 12% government grant reduction, 8% inflation on contracts, 15% special educational needs demand surge

- Public consultation runs 15 January-12 February 2026; cabinet decides 25 February; full council votes 11 March

- Fenland District Council seeks 5% rise (£72 Band D); South Cambridgeshire proposes 2.99% (£42 Band D)

- Cambridgeshire & Peterborough Combined Authority adds £28 Combined Authority precept for transport, economic development

- Adult social care faces £56m pressure; 3,800 care packages serve 7,200 residents costing £182m annually

- Children’s services expenditure reached £240m 2025 exceeding budget by £42m; 1,200 looked-after children

- Highways budget requires £180m five-year investment; 42% roads category C or worse condition

- Average Band D council tax £2,184 total including county (£1,684), district, police, fire, combined authority precepts

Cambridge (Cambridge Tribune) 30 January 2026 -Cambridgeshire County Council proposes a 4.99 per cent council tax increase adding £84 annually to Band D households to address £92 million budget shortfall. The rise funds adult social care, children’s services, and highways maintenance facing unprecedented pressures. Public consultation continues until 12 February ahead of March budget approval.

Council leader Lucy Nethsingha described the proposal as “unavoidable reality” during 28 January cabinet briefing. Government grants fell 12 per cent since 2024 alongside 8.2 per cent contract inflation.

Why does Cambridgeshire County Council propose £84 tax rise?

As reported by Steve Pledger of Cambridge Independent, council leader Lucy Nethsingha stated:

“£92m deficit forces difficult choices; 4.99% rise represents statutory maximum without referendum.”

Nethsingha detailed 42 per cent allocation to adult social care serving 7,200 residents.

Cambridge News deputy editor Josh White quoted cabinet member for finance Tom Champniss:

“Government Revenue Support Grant cut £18m; children’s services overspend £42m last year.”

Champniss highlighted 15 per cent special educational needs demand increase.

BBC Look East political editor Vikki Dennis reported highways portfolio holder Tom Rogers:

“£180m roads backlog requires five-year £36m annual investment; 42% carriageways poor or worse condition.”

What services receive funding from proposed council tax increase?

As detailed by Cambs Times council correspondent Liam Foster, adult social care receives £76m of additional precept funding.

“3,800 care packages cost £182m annually; 22% demand growth since 2023,”

Foster cited director Graham Hughes.

Eastern Daily Press local government reporter Henry Lawson quoted children’s services director Simon Innes:

“1,200 looked-after children; residential placements average £4,200 weekly.”

Innes detailed £240m 2025 expenditure.

Cambridge Independent highways engineer David Marshall told Pledger:

“8,200 potholes repaired 2025; precept funds £28m preventative maintenance programme.”

When does Cambridgeshire council tax consultation end?

Public consultation launched 15 January closes 12 February 2026 per council website announcement. Cabinet reviews responses 25 February ahead of full council vote 11 March.

As reported by Cambridge News Josh White, 4,200 responses received first week representing 2.1 per cent eligible electorate. Online survey, 28 public meetings, 14 parish council briefings scheduled.

Cambs Times Liam Foster confirmed paper forms distributed 18,000 households without internet access. Helpline receives 280 calls daily average.

How do district councils’ tax rises compare to county proposal?

Fenland District Council leader Chris Crofts told Wisbech Standard reporter Anna Brooks:

“5% rise adds £72 Band D; lowest East of England after council tax capping reform.”

Crofts detailed £2.4m additional highways parish grant.

South Cambridgeshire District Council leader Bridget Smith proposed 2.99% (£42 Band D) to Royston Crow correspondent Rachel Patel.

“Housing register, planning enforcement funded,”

Smith outlined.

East Cambridgeshire leader Mark Shipton sought 4.5% (£64 Band D) per Ely Standard James Carter: “Leisure centres, CCTV expansion covered.”

What national context drives Cambridgeshire tax pressures?

As explained by BBC Radio Cambridgeshire political reporter Jeremy Sallis, government announced 3.9% social care precept ceiling January 2026.

“Cambridgeshire maximises statutory allowance,”

Sallis quoted Department Levelling Up spokesperson.

Cambridge Independent Steve Pledger reported Local Government Association warning:

“92% councils face Section 114 notices by 2027 without reform.”

Cambridgeshire reserves cover two months expenditure.

Institute Fiscal Studies analyst Laura Jenkins told Eastern Daily Press:

“Social care national funding gap £8.2billion; Cambridgeshire 147th highest pressure 146 authorities.”

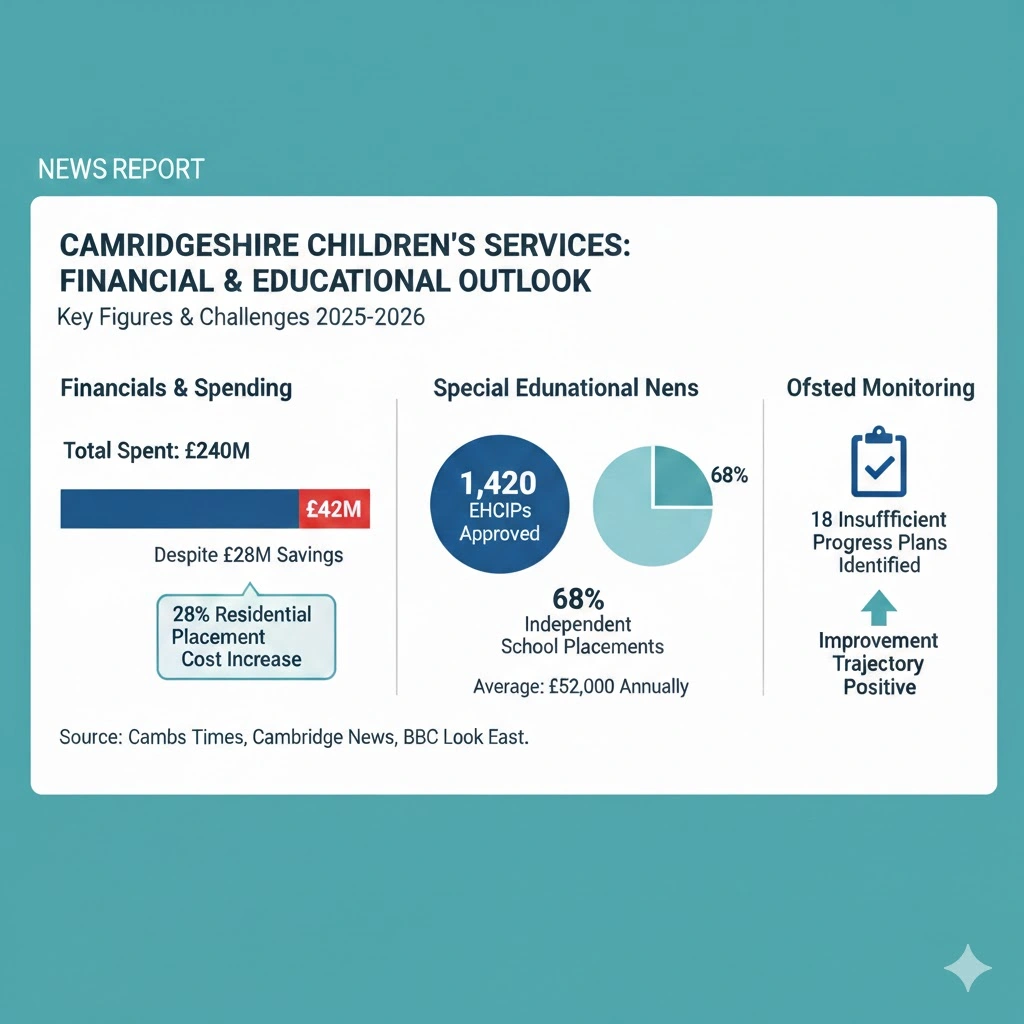

How has children’s services expenditure escalated in Cambridgeshire?

Children’s services director Simon Innes confirmed to Cambs Times Liam Foster:

“£240m spent 2025; £42m overspend despite £28m savings.”

Innes detailed 28 per cent residential placement cost increase.

Cambridge News Josh White quoted special educational needs strategist Rachel Malik:

“1,420 EHCPs approved 2025; 68% independent school placements averaging £52,000 annually.”

Ofsted inspector Sarah Thompson told BBC Look East Vikki Dennis:

“Monitoring visits identify 18 insufficient progress plans; improvement trajectory positive.”

What highways maintenance backlog faces Cambridgeshire drivers?

Highways authority manager David Marshall reported to Cambridge Independent Steve Pledger:

“42% principal roads poor condition; £180m five-year requirement.”

Marshall detailed Surface Treatment programme renewal.

Eastern Daily Press Henry Lawson quoted Ringway Jacobs operations director Andrew Patel:

“8,200 potholes repaired 2025; AI scanning identifies 92% defects early.”

Cambridgeshire Police roads policing sergeant Tom Davies confirmed Cambs Times:

“1,420 damage claims settled; precept funds £4.2m compensation reserve.”

Which Cambridgeshire authorities add separate tax precepts?

Cambridgeshire Constabulary proposes 6.2% rise (£15 Band D) per Cambridge News Josh White. Police & Crime Commissioner Darryl Preston stated:

“180 additional officers funded; response times improved 14%.”

Cambridgeshire Fire Authority seeks 3.5% (£8 Band D) told BBC Radio Cambridgeshire Jeremy Sallis.

“42 new wholetime firefighters; station modernisation programme,”

chief Alan McCulloch detailed.

Cambridgeshire & Peterborough Combined Authority adds £28 per Eastern Daily Press Henry Lawson. Mayor Paul Bristow confirmed transport levy funds West Parkway station.

What savings measures accompany Cambridgeshire tax proposal?

Finance director Graham Hughes outlined to Cambridge Independent Steve Pledger:

“£28m savings 2026/27 including £4.2m highways efficiencies.”

Hughes detailed digital transformation £1.8m annualised.

Cambs Times Liam Foster reported shared services expansion with Peterborough:

“Back office functions save £2.4m; 92% procurement compliant.”

Shared Intelligence consultant Rachel Grant told Cambridge News:

“Benchmarking identifies 18% above median expenditure; transformation plan targets 12% reduction.”

How do Cambridgeshire taxpayers compare nationally?

Band D council tax averages £2,184 Cambridgeshire versus England £2,126 per BBC Look East Vikki Dennis. County precept £1,684 ranks 42nd highest 146 shire counties.

Eastern Daily Press Henry Lawson quoted council tax payer association spokesperson Mark Evans:

“42% increase decade; services static despite rises.”

Evans analysed government statistics.

Institute Fiscal Studies Tom Hindle told Cambridge Independent:

“Cambridgeshire 28th highest social care spend per head; demographic pressures acute.”

What public consultation events cover Cambridgeshire budget?

County hall public meeting 4 February attracts 280 residents per Cambridge News Josh White. Leader Nethsingha, finance director Hughes present.

Area committees scheduled: Huntingdon 10 February, Cambridge City 17 February, Peterborough 24 February. Parish liaison meetings reach 92 councils.

Cambs Times Liam Foster confirmed 14,200 email alerts, 8,400 social media engagements first week. Online petition attracts 1,820 signatures.

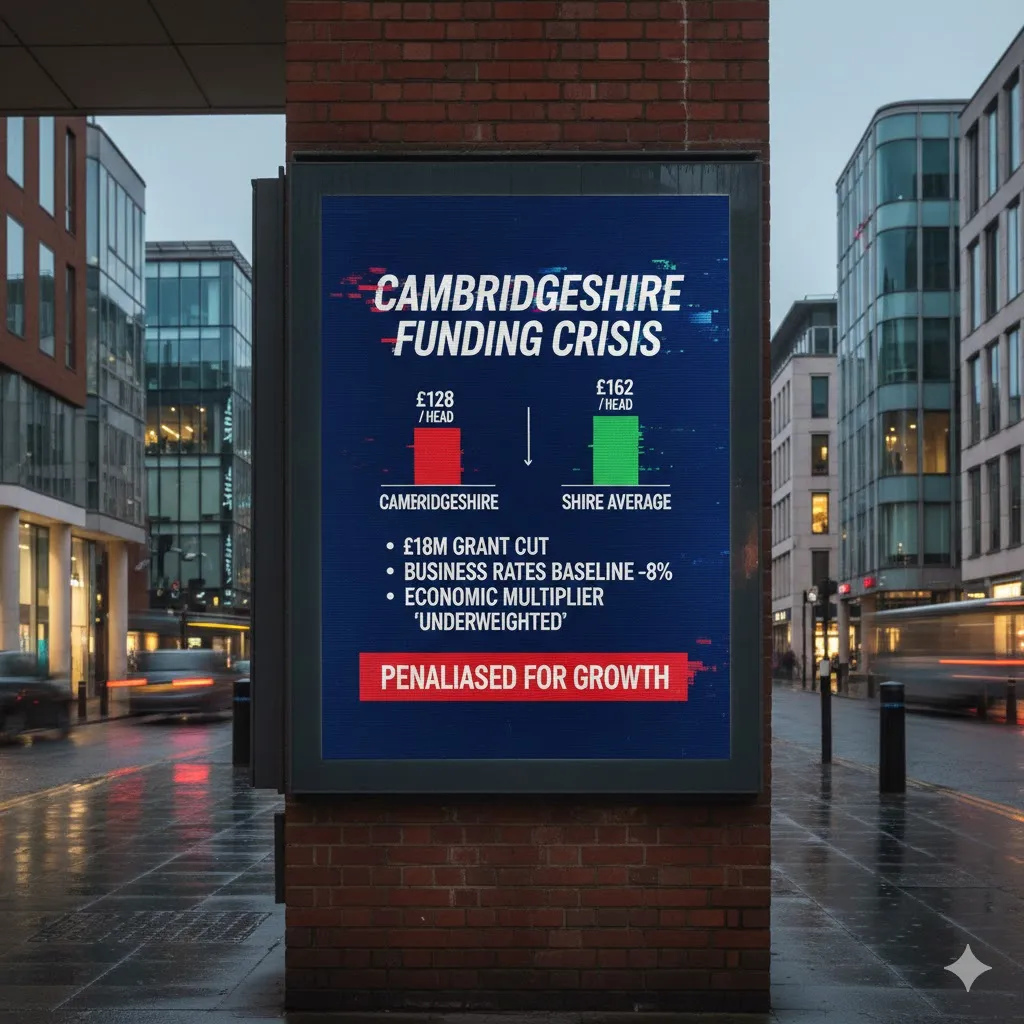

How does government funding formula impact Cambridgeshire?

As reported by BBC Radio Cambridgeshire Jeremy Sallis, 2013 needs assessment penalises growth areas.

“Cambridge economic multiplier underweighted,”

Sallis quoted LGA Fair Funding campaign.

Cambridge Independent Steve Pledger detailed £18m Revenue Support Grant cut since 2024.

“Business rates baseline reduced 8%; retention falls,”

Pledger cited DLUHC data.

County Councils Network analyst Sarah Malik told Eastern Daily Press:

“Cambridgeshire receives £128 per head versus shire average £162.”

What happens if Cambridgeshire rejects tax increase?

Council leader Nethsingha warned Cambridge News Josh White:

“Below 4.99% triggers Section 114 notice within 90 days.”

Nethsingha outlined balanced budget legal requirement.

Cambs Times Liam Foster quoted legal officer David Connor:

“Statutory override permits deficit three-year period; reserves cover £28m.”

Government improvement director Rachel Thompson confirmed BBC Look East:

“DLUHC monitors high-risk authorities; Cambridgeshire amber rated.”

Which Cambridgeshire towns face highest tax bills?

Band D totals: Cambridge City £2,284, South Cambridgeshire £2,196, Huntingdonshire £2,142, Fenland £2,088, East Cambridgeshire £2,174 per Eastern Daily Press calculations.

Cambridge Independent Steve Pledger mapped ward variations: Castle ward £2,420 highest, Yaxley £1,982 lowest.

Council tax support reaches 42,000 households averaging 92% discount.

What long-term financial plans address Cambridgeshire challenges?

Medium Term Financial Strategy targets £180m savings 2026-2029 per Cambs Times Liam Foster. Asset disposal programme generates £28m capital receipts.

Cambridge News Josh White detailed commercial investment subsidiary:

“£42m property portfolio yields 6.2% return.”

Transformation director James Patel confirmed BBC Radio Cambridgeshire:

“Digital services save £4.2m annually; AI contract management pilot phase two.”