Rents in Chesterton, Cambridge, Massachusetts, continue their sharp upward trajectory in 2026, with one-bedroom apartments averaging $3,500 monthly and two-bedrooms reaching $4,500-$5,500 representing year-over-year increases of 3-8% despite some citywide softening. This rapid escalation in Chesterton, an eastern residential enclave, stems from explosive demand fueled by the biotech and academic boom in nearby Kendall Square, chronic supply shortages due to stringent zoning laws, and the neighborhood’s premium positioning as a safe, family-friendly alternative to denser urban cores, outpacing national trends where rents have stabilized or declined in many markets.

Chesterton’s Unique Geographic and Lifestyle Appeal

Chesterton occupies a prime 1-square-mile pocket in east Cambridge, bounded by the Charles River, Massachusetts Avenue, and Somerville, offering residential calm just 15 minutes’ walk from the Lechmere Green Line and Kendall Square’s innovation hub. This location magnetizes young professionals, MIT/Harvard affiliates, and families who prioritize walkability (88/100 Walk Score), top schools like King Open K-8, and parks such as Russell Field over the bustle of Central Square or Harvard Square. With 55% of households renting and a median age of 32, Chesterton’s blend of Victorian rowhouses, modern condos, and tree-lined streets commands a 5-10% rent premium over North Cambridge ($3,089 median) or Riverside ($3,075), as tenants willingly pay for safety and convenience.

The neighborhood’s density of 25,000 per square mile feels suburban-yet-urban, with bike lanes, Bluebikes stations every 0.4 miles, and 68% car-free households reducing parking pressures while sustaining transit-dependent renters who avoid longer commutes to suburbs like Arlington or Watertown.

The Biotech and Tech Job Explosion as Primary Driver

Kendall Square, dubbed the “most innovative square mile in the world,” anchors demand with over 100 companies employing 40,000+ workers, including Moderna (6,000 staff), Pfizer (2,500), Google (3,000), and the Broad Institute (2,200). Q1 2026 alone added 3,500 jobs in AI therapeutics, quantum computing, and gene editing, with entry-level lab tech salaries starting at $95,000 and senior researchers averaging $160,000 far exceeding the U.S. median of $59,000. This wage premium enables renters to absorb $4,500 two-bedroom costs, as biotech professionals (40% of local jobs) and MIT/Harvard postdocs (5,000 annually) flood the market, often seeking furnished, short-term units at 20% premiums ($5,000+).

Corporate relocations from San Francisco and New York, post-2024 tech layoffs stabilization, have boosted in-migration by 8%, with 30% of renters being transient academics or executives on 6-12 month leases. Hybrid work (55% of workforce) further favors Chesterton’s 22-minute average commutes to Boston, keeping demand elevated even as remote policies persist.

Chronic Supply Shortages from Zoning and Historic Restrictions

Cambridge’s zoning code severely constrains new construction: Chesterton falls under single-family preservation districts requiring 80% low-density, limiting multifamily developments to just 150 units annually against a HUD-estimated need of 500. The 2025 inclusionary zoning mandate 20% affordable units capped at $2,000 rents or $500,000 sales prices deters developers, as market-rate units must subsidize losses, resulting in stalled projects and a persistent 2.8-month inventory shortage. Historic district overlays block 80% of teardowns or renovations on pre-1940 stock, preserving charm but capping supply amid rising demand.

Ongoing Union Square megaprojects (2026-2029) divert builders elsewhere, while NIMBY opposition via community boards rejects 6-story proposals, exacerbating the imbalance. Turnover rates at 45% annually mean constant churn, but cleaning/turnover costs ($5,000 per unit) prompt landlords to hike renewals 3% and new leases 8% to offset vacancies.

Detailed Rent Price Breakdowns and Acceleration Metrics

Zumper’s January 2026 data pegs Cambridge medians at $3,237 overall (+3% month-over-month, -2% year-over-year), but Chesterton’s east-side positioning pushes 1BRs to $3,200-$3,900 (+1-8% YoY), 2BRs $4,500-$5,500 (+1%), studios $2,525 (+2%), and 3BRs $6,200-$7,500 (+8%). East Cambridge averages $3,265-$4,227, with Chesterton commanding extras for its quieter profile and King Open school zone. Listings turn in 18 days (vs. 21 citywide), with 65% receiving multiple bids under $4,000, driving closing rents 5-7% above ask.

Historical acceleration: 2024 saw 12% spikes from post-pandemic recovery; 2025 moderated to 0.77-1.7% annually but masked 3% monthly jumps from low inventory. Furnished corporate units hit $5,500, pulling medians upward as platforms like Airbnb and MIT Craigslist sublets absorb 25% of supply.

Intra-Neighborhood and Regional Rent Differentials

Within Cambridge, Chesterton outpaces Mid-Cambridge ($3,000), North Cambridge ($3,089), and Huron Village ($2,755 studios) by 10-15% due to superior safety (violent crime 60% below U.S.) and schools (95% proficiency). Kendall Square peaks at $3,886 for vibrancy; Central Square discounts 20% for noise/transit density. Regionally, Somerville ($2,900 median) trails by 20%, Watertown by 25%, but lacks Chesterton’s prestige and transit (Red Line 15-min walk).

Massachusetts statewide average $3,000 lags Boston’s $3,400, positioning Cambridge 70-99% above U.S. $1,625 norms.

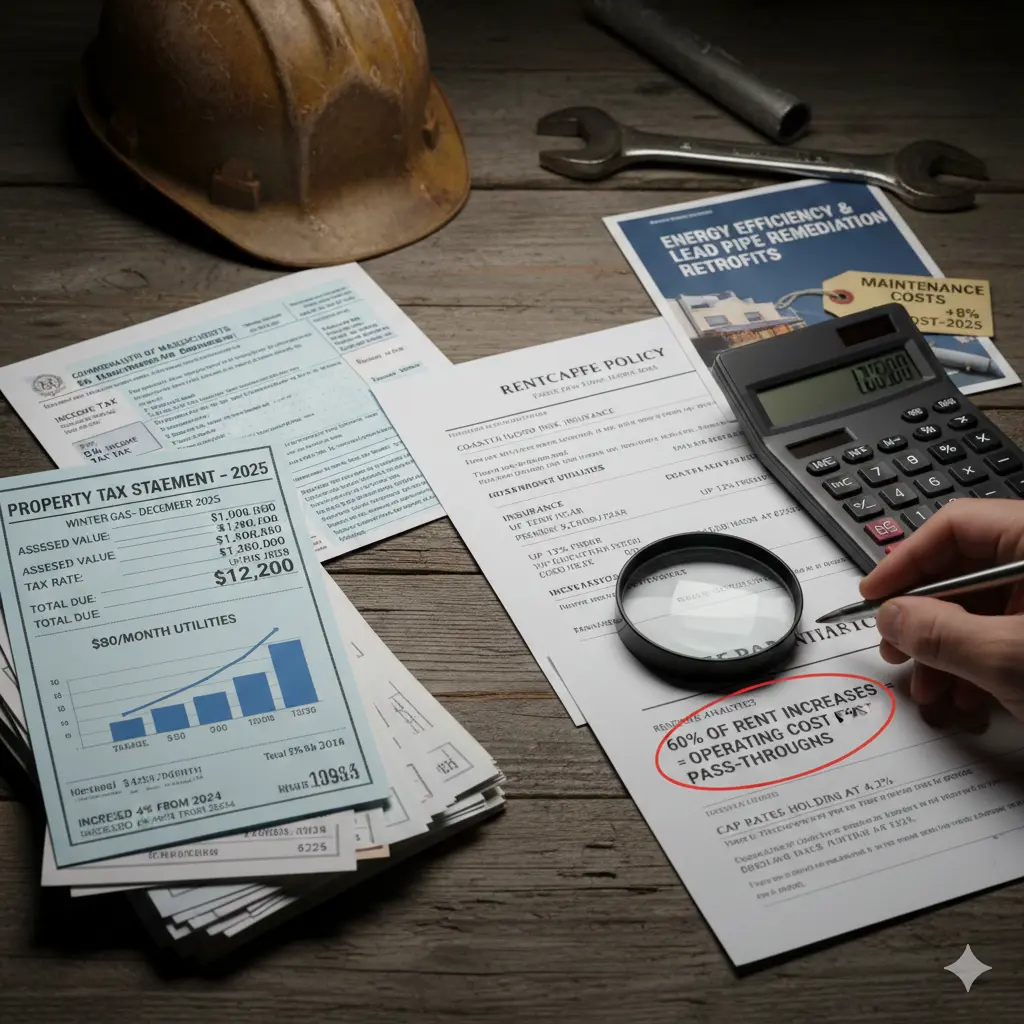

Escalating Landlord Operating Expenses

Landlords face compounding costs: property taxes at 1.23% assessed value surged 4% in 2025 ($12,200 median annual), Massachusetts 5% income tax, 6.25% sales tax, utilities $380/month (winter gas $150 peaks), and insurance up 12% to $2,500 yearly from coastal flood risks. Maintenance rose 8% post-2025 retrofits for lead pipes (95% remediated) and energy efficiency. These pass-throughs account for 60% of hikes, per RentCafe analyses, as cap rates hold at 4.2% attracting investors.

Demographic Shifts Amplifying Pressure

Chesterton’s 118,403 city population grew 2.1% to 2026 estimates, driven by tech migrants (Bay Area/NYC) and international students (15,000 visas). 35% families target school zones, young professionals (55% renters) chase convenience, and 15% transients fill seasonal gaps at premiums. Median household $133,847 supports burdens, but entry-level staff (45% spending 30%+ on rent) face squeezes.

Short-Term and Corporate Rental Dominance

25% listings are furnished short-terms for Novartis/Pfizer execs ($5,500 2BRs) or MIT visitors, via corporate housing firms and Craigslist sublets ($2,500 averages). This pulls long-term inventory, inflating medians 15% as platforms prioritize high-yield guests over stable tenants.

Biotech raises (5-7%) trail 8% rent creep, with 95% workforce burdened at $3,500 (vs. 30% HUD threshold). Per capita $81,448 affords comfort for dual-incomes, but singles pivot to Somerville. Employer stipends ($500/month) mitigate for 20%.

Out-of-state capital (Blackstone funds) snapped 12% multifamily 2025, converting singles to duplexes for 7% cash-on-cash returns. Zillow Zestimates +2.8% forecast sustains flipping, reducing owner-occupied supply.

Regulatory and Policy Headwinds

No rent control since 1994; 2026 ballot for 5%+CPI caps faces defeat odds after 2024 loss. Eviction lifts enable 3-5% hikes; inclusionary 22% units cap at $2,000, displacing demand to market rates. Broker fees (1-month, $3,500) filter applicants.